CASE STUDY

CLIENTThe Lending Outlet

MARKETLoans for those with poor credit

PROGRAMBrand identity and program

The Lending Outlet, a subsidiary of an established community credit union.

Potential borrowers who would likely turn to high-interest credit cards and/or unscrupulous payday lenders for quick cash. Focus on young adults/families, and homeowners who wish to make home improvements.

SELCO developed The Lending Outlet to provide loans that would help those with poor credit build their financial future. The goal was to quickly launch the new brand and build an energetic new financial marketing strategy to appeal to young people. The introductory marketing program needed to quickly build loan volume among target audiences.

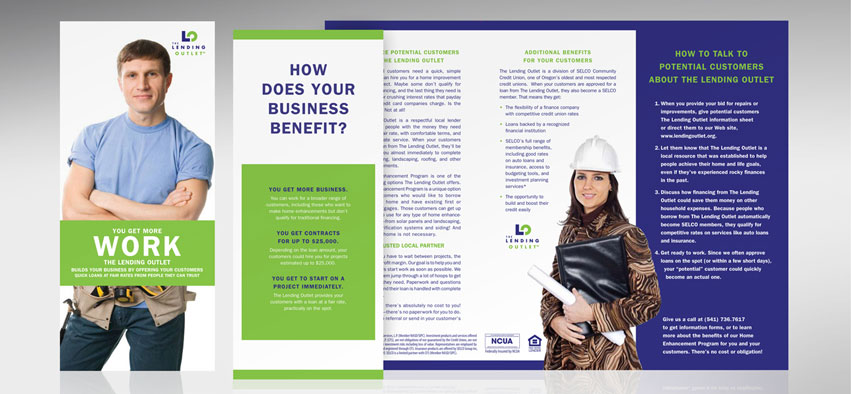

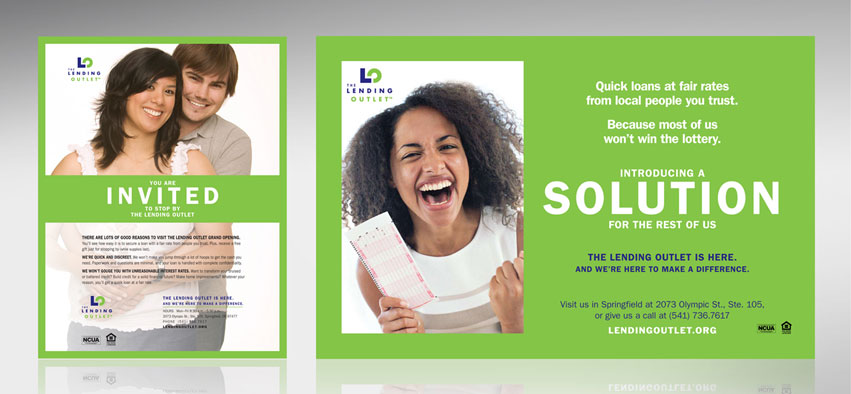

The brochure (left) introduced the new financial brand to target audiences. The bus poster (right) grabbed attention.

The brochure (left) introduced the new financial brand to target audiences. The bus poster (right) grabbed attention.

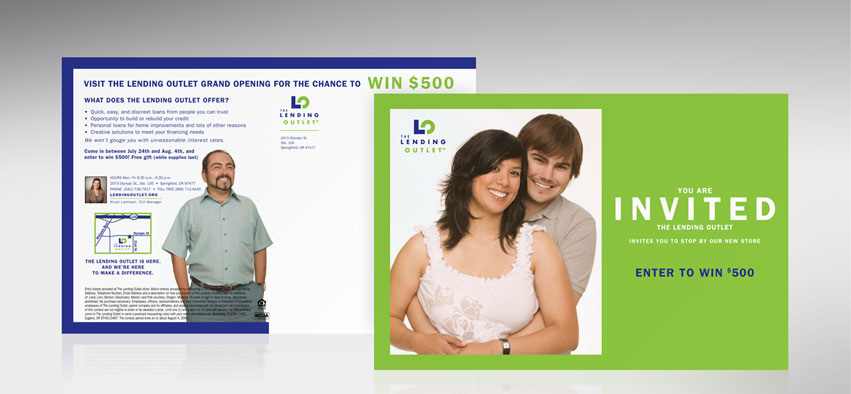

Using bright colors and playful but direct messaging, we engaged a youthful and diverse audience. The crisp blue and green color palette supported the unique approach to subprime lending—a quick, simple loan process, flexible options and competitive rates from an established, trustworthy source. The messages gave borrowers with bruised or no credit a sense of hope for rebuilding or building their financial future.

We chose advertising and bus posters to get the word out. An invitation and introductory event reached neighborhoods around the location for the brand launch. The bright color palette was also incorporated into oversized posters in the office. We created a successful bank brand that shifted the perception of sub-prime lending.

Within its first 30 days of business, The Lending Outlet quadrupled its goal for net loan growth and members served. Volume continued to exceed goals within the first year, prompting plans to open a second location. Walk-in business outpaced referrals, further proving the effectiveness of the financial marketing program.